For people who play 80 hours instead of working 40, a diversified career portfolio often emerges.

A variety of activities and the contemporary energy of popcorning between them, helps vanguards stay ahead of the innovation curve. Diversification of work can also provide stability when the volume of different activities are strategically adjusted over time.

As we diversify career portfolios, balance, transparency, being realistic, patience, perpetual learning, and avoiding The Headline Trap is critical. These real skills fuel focused progress on multiple fronts and help reduce the risk of diluting yourself to mediocrity. If you’re stretched too thin, the value of diversification can devolve into fragmentation.

Extra Shot

It’s easy to discount our potential, but life is too short not to love what you do.

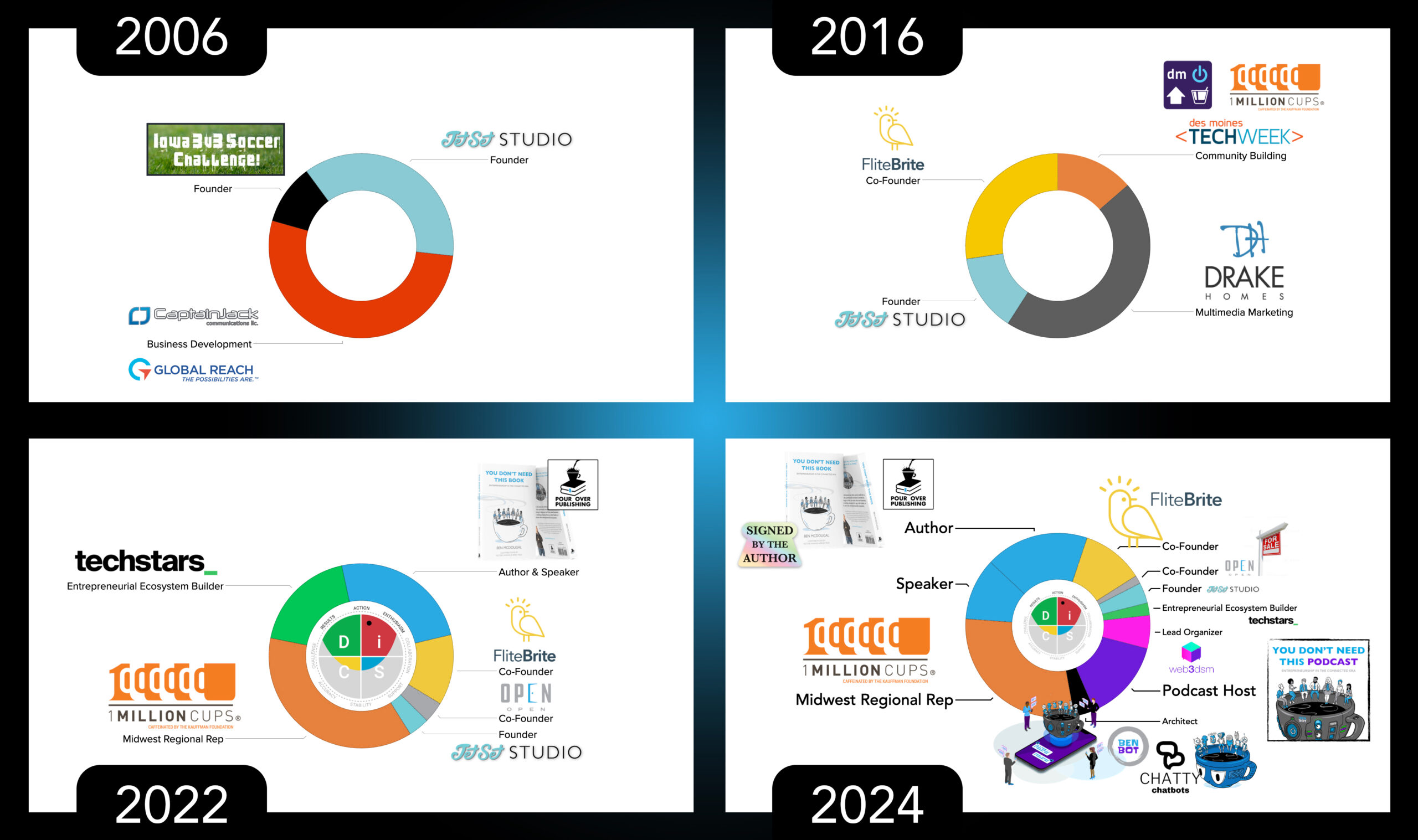

When change is constant, visualized assessment helps track how time is spent. Below is the evolution of my own career portfolio. People who see this often want to implement this method introduced in the Side Hustles chapter of YDNTB, so let’s jam on how to visualize your diversified career portfolio.

First, organize the things you spend time building. Assign a percentage of time spent on each activity, then plot the data into a pie chart. I use Apple Keynote to manage the pie chart and Adobe Photoshop for added flare, but any spreadsheet or slide deck software can visualize data in a similar way. Once created, save the pie chart as an image. You now have a conversation piece that showcases how you spend time. Update it as your career portfolio evolves or use this method as an annual exercise to stay balanced with your own personal bandwidth.