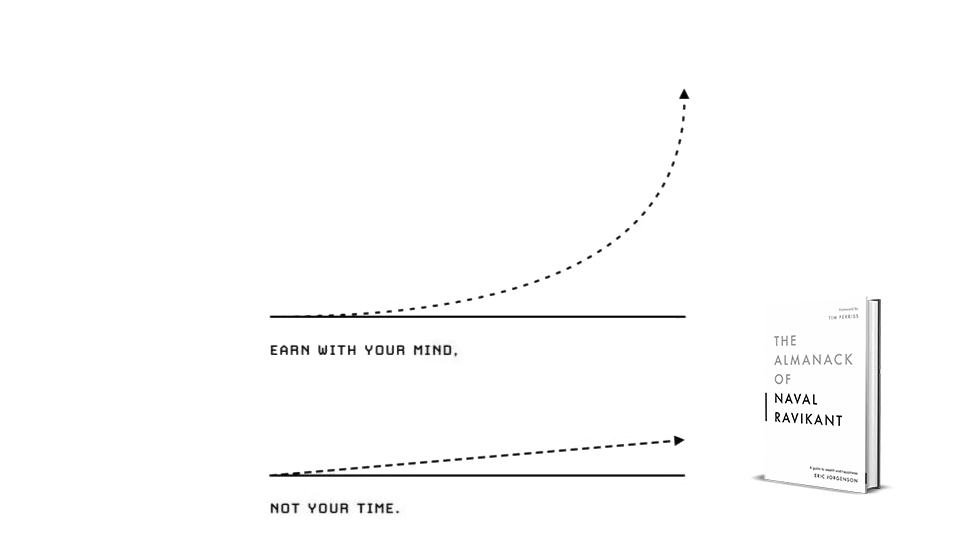

We use linear thinking in an exponential universe.

From a blade of grass on the football field, how can one imagine gaining a single yard? The first down marker feels distant at best, a touchdown seems impossible, and winning the game is barely comprehensible. A season championship? Yeah, that’s not even a glimmer in our mind’s eye. Trying to win all at once makes movement daunting, but staying consistent builds confidence and unlocks efficiencies. When space from this efficiency is used to stay innovative, what’s working is fortified as wormholes connect new levels of momentum.

We all know this.

Let’s dig deeper.

If a linear thinking is status quo, opportunity awaits those who augment their work through a cosmic perspective. As signals of product-market-fit emerge, understanding how each part effects the system will optimize what must work. This awareness leads to stability, which tempts most to coast along a linear path. People like us know that while it’s important to respect past success, such nostalgia does not guarantee the same results within a neon future characterized by constant change.

Yes, paving an exponential path takes endless energy, but we play for 80 hours to avoid working 40 and your creative eagerness can be nourished by a peculiar lack of routine. The goal is not more of the same. That will lead to similar, linear results. Instead, maintain what works, then keep increase the curve’s trajectory by feeding new ideas, talent, collisions, and action into the system.

You knew this was coming, but as always, an easy way to go beyond our linear capabilities is found in community. Community allows us all to do more with less. Curiosity, initiative, and adaptability activates diversified trust channels. Fresh feedback rewards a willingness to experiment and when integrity to follow up is applied, variables can be added to a more exponential equation.

Extra Shot

“Getting rich is about knowing what to do, who to do it with, and when to do it. It is much more about understanding than purely hard work.” –Naval Ravikant

Like the opening analogy reminds us, converting a slope of work from linear to exponential is not done all at once. The Headline Trap is distracting and we often assume it takes luck, but we make our own luck with every action.

As we leverage our own community-driven exploration, we uncover ways to earn more with our mind, not our time. The farther we separate time and money, the less we rent our most precious resources. Each time we find that next gear, the system unfolds and the rising slope of your impact, personal bandwidth, sense of peace, and happiness is set free to rapidly ascend.